7th Floor, Unit B, 8Rockwell, Hidalgo Drive, Rockwell Center, Rockwell Dr, Makati, 1210, Philippines

contactus@simpletpa.com

+63 (2) 8683 7581

Insurance works because it can diversify risk over a large “pool” of people. Companies are a large “pool” of people that represents a relatively diverse risk pool. And given that Filipino HMO-type healthcare plans generally provide only small Maximum Benefit Levels (MBLS) equating to nice, but very basic, “financial assistance” (vs. more robust insurance type protection provided by US-type HMOs), the amount of risk of self-funding healthcare plans in the Philippines is relatively small. But a shift is coming. In the US, even with greater exposure, approximately 80% of large employers have moved fully or partially self-funding their employee benefit packages. And by leveraging technology, like the SIMPLeTPA digital platform, members can significantly enhance member experience accessing their benefits, reduce HR’s time to administer their healthcare plans and reduce overall administrative costs by up to 75%!

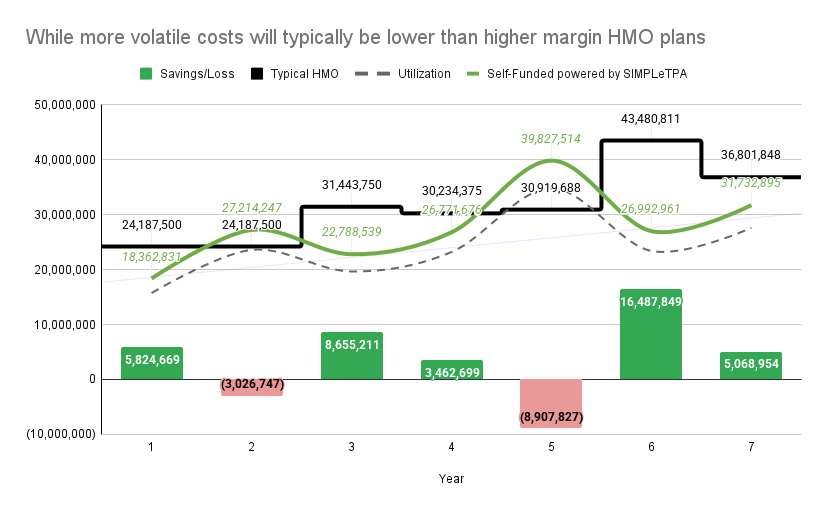

See the illustration below that highlights how, over time, self-funding reveals the potential to save. While HMO-type plans provide a one-year lock in cost, inevitably they must increase if claims ratios exceed a certain percentage — usually if claims meet or exceed 65%. And they tend to be slow to reduce fees (or provide only limited rebates) when claims are low. So overtime, it will cost more money.

This is an illustration only and not an offer or guarantee of any sort as SIMPLeTPA is an administrator and does not provide any guarantees on costs — we operate on a SIMPLe fixed fee basis.